-

Our Vision

To be a world class Revenue Authority respected for its professionalism, efficiency, fairness, integrity and its contribution to our economic and social development.

-

Our Mission

To continually reform and modernise Revenue Administration in order to manage and operate an effective and efficient Revenue organisation comprising of highly motivated and skilled staff.

-

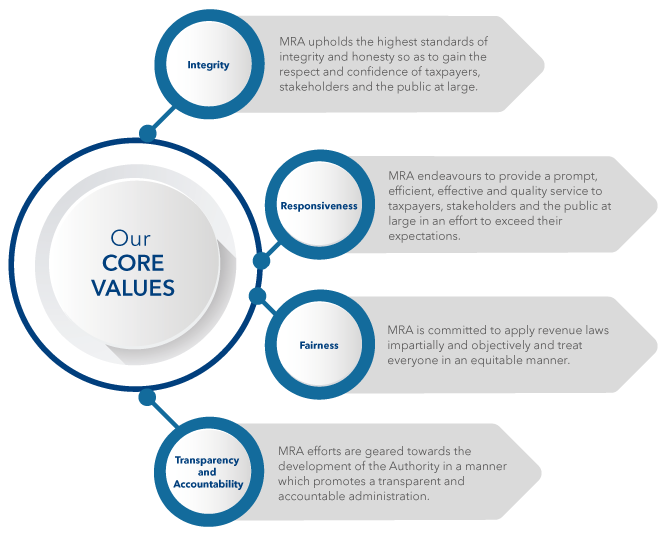

Our Core Values

-

Our Role

The Mauritius Revenue Authority (MRA) is a body corporate, set up to manage an effective and efficient revenue-raising system. It administers and collects taxes due in Mauritius within an integrated organisational structure.

The MRA is an agent of State and, as such, the Ministry of Finance and Economic Development continues to have overall responsibility for the organisation and monitors its performance.

The MRA is responsible for collecting approximately 90% of all tax revenues and for enforcing tax laws in Mauritius.

The MRA collects:

Direct Taxes

-

Corporate Tax

-

Personal Income Tax

-

Tax Deduction at Source (TDS)

Indirect Taxes

-

Value Added Tax (VAT)

-

Customs Duties

-

Excise Duties

-

Gambling Taxes

Fees & Levies

-

Passenger Fees

-

Passenger Solidarity Fees

-

Environment Protection Fees

-

Advertising Structure Fee

-

Special Levy on Banks

-

Special Levy on Telecommunications Companies

-

Fees payable in respect of several licences & for the issue of Tax Residence Certificates (TRCs)

The MRA has additional responsibility for collecting:

-

National Pension Fund (NPF) / National Savings Fund (NSF) contributions

-

Contribution Sociale Généralisée

-

HRDC Training Levy

-

Workfare Programme Fund

-

Contributions payable under the Mauritius Cane Industry Authority Act

-

Net proceeds for the Lotto Fund

-

Corporate Social Responsibility levies

-

Levy payable by gambling operators to the Responsible Gambling & Capacity Building Fund

-

Portable Retirement Gratuity Fund (PRGF)

The MRA also administers and pays:

-

Negative Income Tax

-

CSG Income Allowance

-

Independence Allowance

-

Financial Assistance to Employers: Payment of National Minimum Wage and Salary Compensation 2024

-

Financial Support to Business Operators following increase in the price of “Diesel”

-

Financial Assistance to Households: Power Cuts for 12 consecutive hours during the passage of cyclone Belal

-

Housing Loan Relief Scheme

-

Prime à L’Emploi Scheme

-

CSG Child Allowance - Rs 2,000 Monthly

-

Payment of Subsidy on Scheduled breads to Bakeries

-